4 Unexpected Aspects Covered by Medicare

- Posted on Nov. 7, 2023

- Health

- Views 64

Medicare is widely recognized for its provisions related to hospitalization and routine medical consultations. However, many are unaware of the various other advantages that this health insurance program offers. By delving deeper into these lesser-known aspects of Medicare, beneficiaries can make more enlightened healthcare choices.

Read More

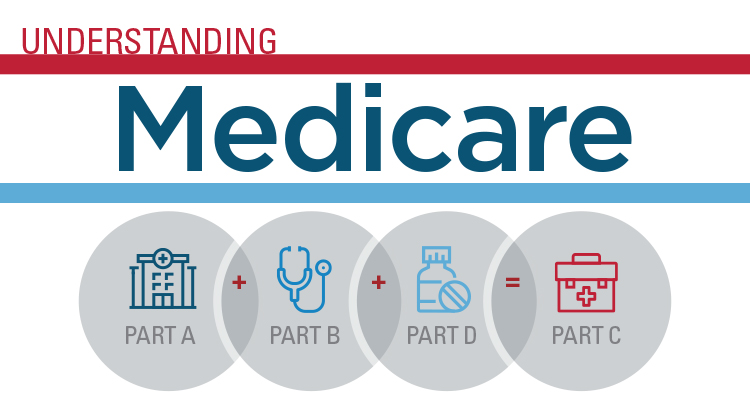

An Overview of Medicare

Established to make healthcare more accessible and affordable, particularly for seniors, Medicare has grown to cater to individuals with specific health challenges as well. It's categorized into various segments, each serving distinct health needs:

Hospital Coverage (Part A): Encompasses hospitalizations, hospice care, home health provisions, and skilled nursing care facilities.

Outpatient Medical Services (Part B): Focuses on outpatient medical expenses, which include consultations, preventative services, and durable medical equipment.

Comprehensive Plans (Part C or Medicare Advantage): A holistic package offered by private insurance entities, incorporating the benefits of Parts A and B, and often extending to vision, dental, and auditory care.

Medication Coverage (Part D): Specifically for prescription medicines.

Additional Coverage (Medigap): Supplements that bridge the gap left by Original Medicare Coverage for those not opting for Medicare Advantage plans.

It's worth noting that with Original Medicare, beneficiaries bear certain charges like annual deductibles for Part B (valued at $226 for 2023) and monthly premiums for Part B (pegged at $164.90 for 2023).

Diving Deeper: Four Lesser-Known Medicare Inclusions

When it comes to Medicare, the common perception revolves around basic hospitalizations and routine medical check-ups. However, this comprehensive program extends far beyond the usual services that meet the eye. As we venture below the surface, we uncover four intriguing aspects of Medicare that many beneficiaries might be unaware of.

Digital Health Consultations (Telemedicine)

Embracing the digital age, Medicare beneficiaries can now engage in health services, from psychotherapy to speech therapy, using audio or video tools, sidestepping the need for physical consultations. The fees for such virtual consultations are often parallel to face-to-face interactions. Yet, costs can fluctuate based on:

- Supplementary insurance possessed by the beneficiary, for instance, a Medigap policy.

- The medical professional's specialty and charges.

- Facility type where care is provided.

- Geographical location for availing medical tests and services.

Support to Quit Tobacco (Tobacco Cessation Assistance)

With tobacco being a major preventable cause of fatalities, Medicare Part ABCD endorses up to eight annual counseling sessions aiming to deter smoking or other tobacco use. Beneficiaries aren't charged if their healthcare provider is affiliated with Medicare.

Overseas Medical Aid

Generally, Medicare doesn't account for health services availed outside U.S. territories. However, exceptions are present. Medicare Part B might sponsor treatments in foreign hospitals if:

- The overseas hospital is geographically nearer to the beneficiary's residence than any U.S. facility.

- During emergencies, if the foreign facility is closer and more accessible.

- When traveling from Alaska through Canada to another U.S. state, if a medical emergency arises and the Canadian hospital is the nearest.

Chronic Condition Management

For those grappling with two or more chronic ailments, like diabetes coupled with arthritis, Medicare might cover the costs of devising and supervising an all-inclusive care strategy. This plan can encompass details like diagnoses, medication schedules, required treatments, and coordination blueprints among providers.

Embarking on the Medicare Journey

To begin your Medicare experience, it's crucial to assess and compare the diverse plans in your vicinity. After selecting a suitable plan that aligns with your needs and budget, you can register either online through the Social Security Administration's portal or by placing a phone call to the designated Medicare helpline. Mailed applications are another accessible route for enrollment. It's vital to stay informed and proactive, ensuring you maximize the benefits offered by the program. Enrolling during the initial enrollment phase, which surrounds your 65th birthday, is recommended for a smooth transition. By being diligent about this, you not only secure your health coverage but also potentially save on costs in the long run.